Property managers’ revenue may be growing more than they think [The Lookout]

Buildium

JANUARY 21, 2025

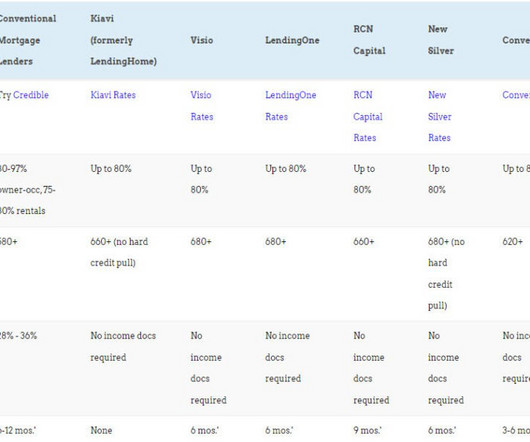

In 2024, we can see that more companies reported equivalent or greater revenue growth than they did in any year between 2017 and 2022. On one hand, companies are anticipating less revenue growth over the next two years than they projected in 2022 and 2023. 41% will expand the services they provide.

Let's personalize your content