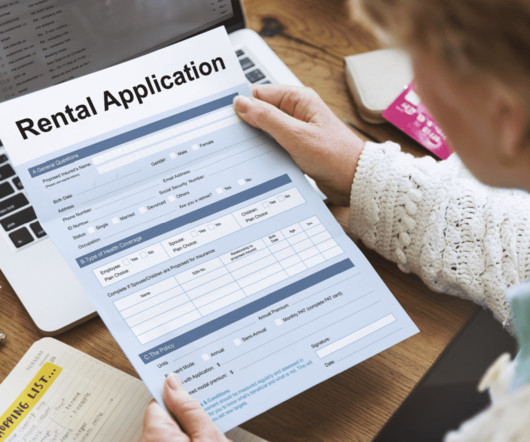

Finding the Perfect Multifamily Property

American Apartment Owners Association

JANUARY 27, 2025

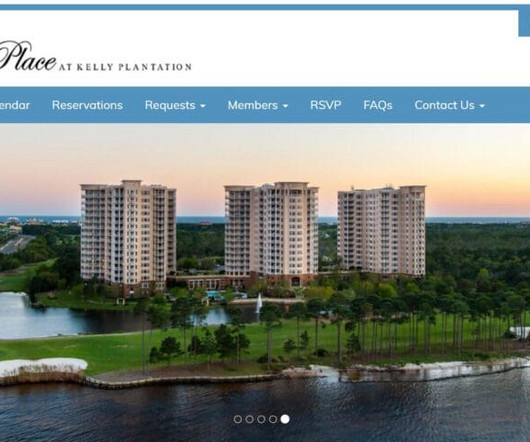

Operating costs can consist of property taxes, real estate agent fees, utilities, maintenance, property management fees, homeowners insurance and legal fees. Take out landlord insurance A landlord insurance policy is meant to protect you as an investment property owner while safeguarding your rental properties.

Let's personalize your content