What Is a Service Contract in Real Estate?

Bay Property Management Group

APRIL 14, 2025

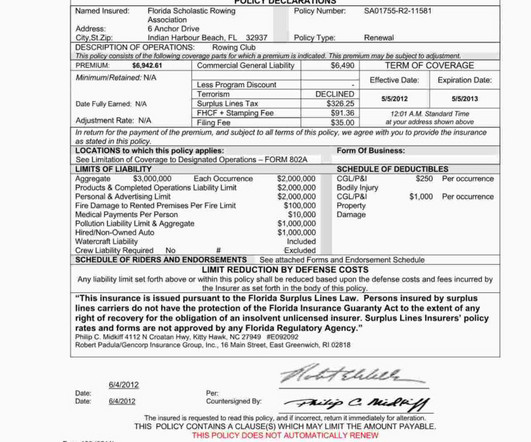

Theres a lot that goes into being a successful landlord. One key piece is the service contract. The term might sound a little vague, and you may be wondering: What exactly is a service contract in real estate? Main Takeaways What are service contracts in real estate? Why Do Landlords and Investors Need Service Contracts?

Let's personalize your content