Can You Deduct Your Own Labor on a Rental Property, Answered

Bay Property Management Group

FEBRUARY 26, 2025

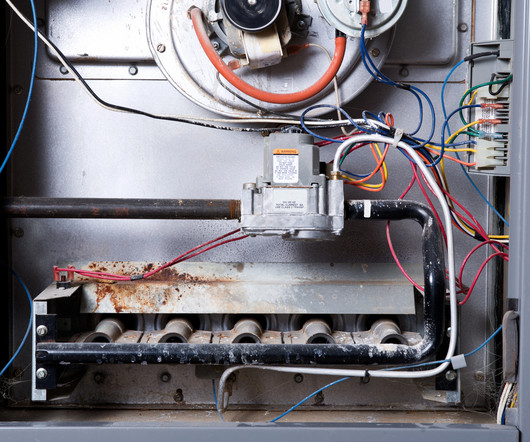

Owning a rental property often means wearing many hatslandlord, accountant, and sometimes even handyman. So, if youre taking care of repairs yourself, can you deduct the cost of your own labor on a rental property? After all, hiring contractors is deductible, so shouldnt your own hard work count too? Read on to learn more.

Let's personalize your content