Professional Property Management: Why It’s Worth the Investment

Real Property Management Chicago

NOVEMBER 8, 2024

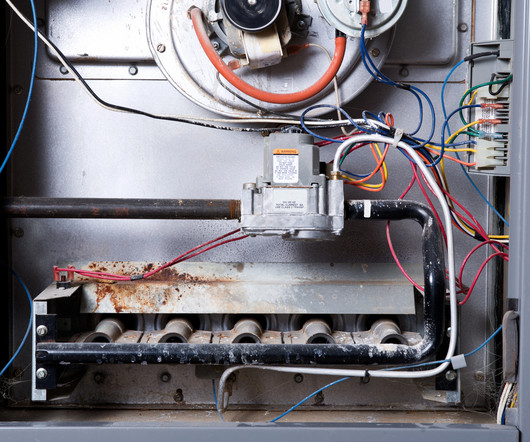

Lower Maintenance and Repair Costs Maintenance and repairs can be a problematic part of rental property ownership, particularly if you are new to being a landlord or don’t have much time to do the work yourself. Distinguishing when a job requires a licensed contractor is sometimes complicated to decipher.

Let's personalize your content