Building a diversified real estate investment portfolio to minimize risk

MRI Software

MAY 19, 2024

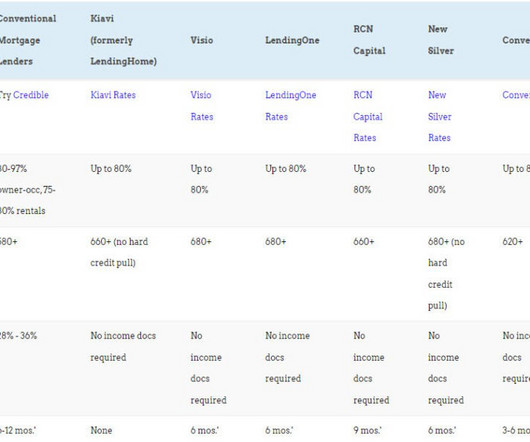

Different property types and locations can have different rental cycles. A diversified portfolio can also help you obtain better financing options. How can you diversify your property portfolio: Types of diversification methods Diversifying your property portfolio is important to reduce risk and maximize returns.

Let's personalize your content