Building a diversified real estate investment portfolio to minimize risk

MRI Software

MAY 19, 2024

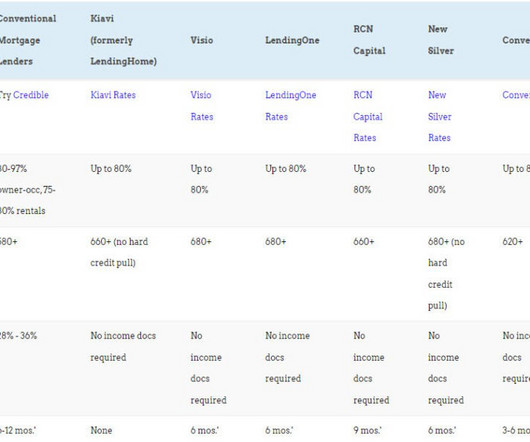

This can include residential, commercial, industrial, and retail properties. Residential properties are often viewed as stable investments with steady demand because. Commercial and industrial properties can offer higher returns, but come with bigger risks. Retail spaces can be affected by economic cycles.

Let's personalize your content