Recession-proof real estate investing: Strategies for a resilient portfolio

MRI Software

JANUARY 24, 2025

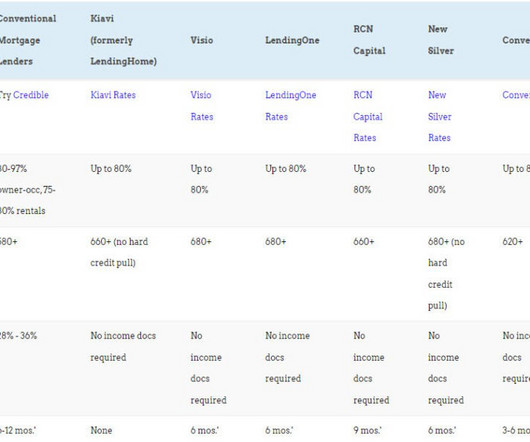

Focusing on recession proof real estate investing with steady tenant demand helps you minimize risk and keep cash flow strong. These property types meet everyday needs, ensuring they retain tenants even when other sectors struggle. Tenant stability The stability of your tenants is a key factor in recession-proof investing.

Let's personalize your content